Surviving the Student Life: How to Reduce College Costs

The Importance of Reducing College Costs

As a student, you may find yourself burdened with the high costs associated with pursuing higher education. However, it doesn't have to be a financial struggle throughout your college years. At The Knowledge Nest, we understand the challenges students face and are here to help you navigate the world of college expenses.

Planning and Budgeting

One of the first steps to reducing college costs is effective planning and budgeting. By creating a detailed plan for your finances, you can identify areas where you can save money and make smart financial decisions throughout your college journey. Consider the following tips:

1. Scholarships and Grants

Start your cost-saving journey by exploring available scholarships and grants. These can significantly reduce the amount you need to borrow or pay out of pocket. Research and apply for scholarships and grants that align with your qualifications, interests, and academic achievements. Remember to submit your applications before the deadlines!

2. Tuition Payment Plans and Financial Aid

Many universities offer tuition payment plans or financial aid options that can help you manage your expenses. Contact your college's financial aid office to explore available resources. They can provide valuable information on options such as work-study programs, student loans, and bursaries.

3. Living Arrangements

The cost of housing is a major contributor to overall college expenses. Consider alternative living arrangements such as sharing an apartment or dormitory with roommates to reduce costs. Additionally, explore off-campus housing options that may be more affordable compared to on-campus alternatives.

4. Textbooks and Study Materials

Purchasing new textbooks can be expensive, but you have options to minimize these costs. Look for used textbooks, online resources, or consider renting textbooks for the duration of the semester. Sell your used textbooks once you're done with the course to recoup some of your expenses.

5. Taking Advantage of Student Discounts

Being a student often comes with perks, including access to various student discounts. These discounts can apply to textbooks, technology, transportation, entertainment, and many other products and services. Always carry your student ID and inquire about available discounts whenever you make a purchase.

6. Transportation

Consider using public transportation, carpooling, or biking to campus instead of relying solely on owning a car. These alternatives can significantly reduce transportation costs, including parking fees and fuel expenses.

Additional Cost-Saving Strategies

In addition to the tips mentioned above, there are other ways to minimize college costs. Here are a few more recommendations:

1. Take Advantage of Free Campus Resources

College campuses often provide a range of free resources for students. Utilize facilities such as the library, computer labs, tutoring services, and fitness centers to avoid unnecessary expenses.

2. Cook Meals at Home

Instead of eating out or relying on expensive meal plans, consider preparing your meals at home. Cooking can be cost-effective and healthier in the long run. Plan your meals, make a grocery list, and enjoy the savings you'll experience.

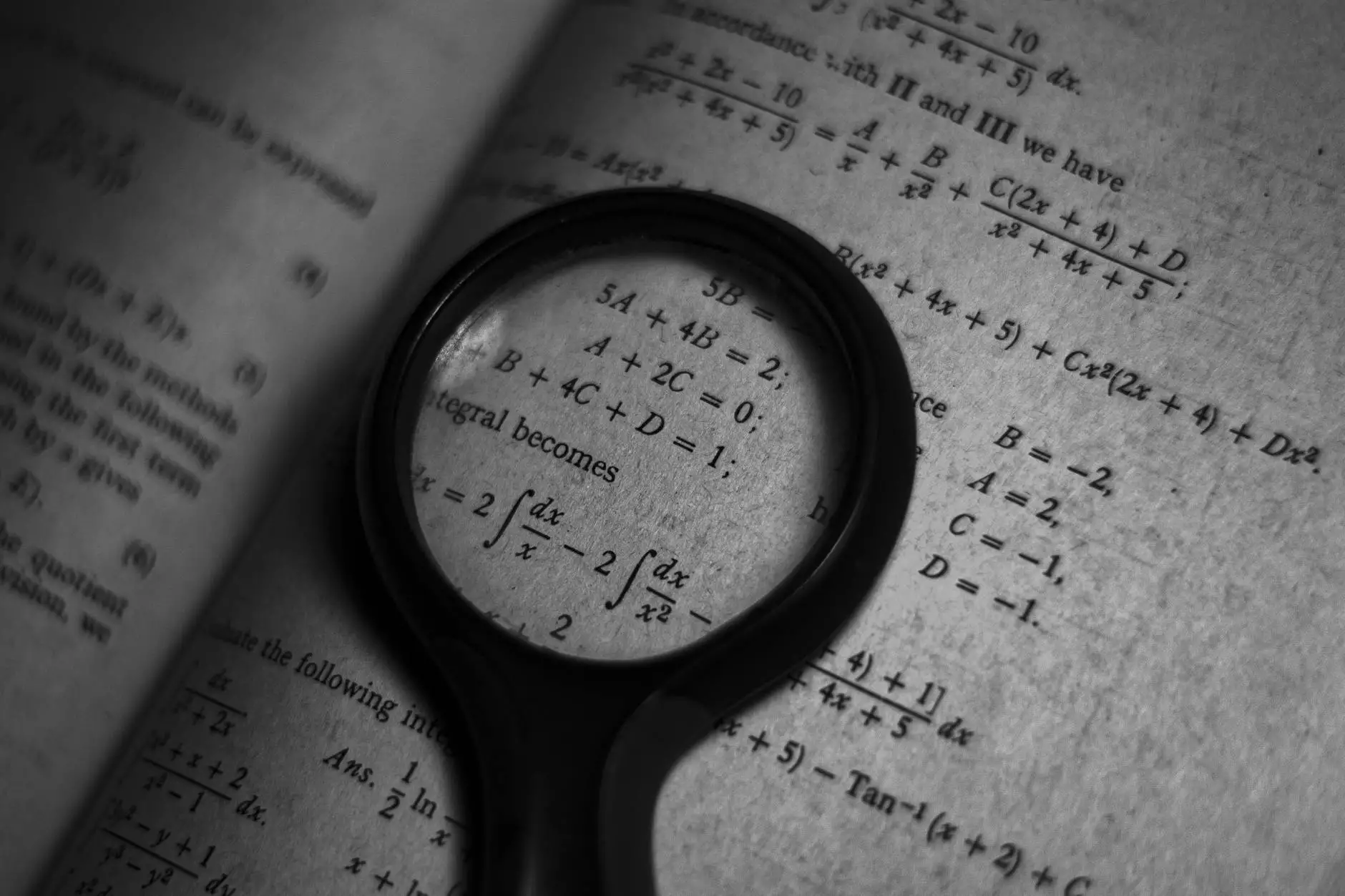

3. Explore Online Course Options

Online courses can offer flexibility and potentially lower costs compared to traditional in-person classes. Research whether your college offers online alternatives for certain courses, which may save you money on commuting and housing expenses.

4. Choose a Financially Friendly Major

While it's important to pursue a field you are passionate about, some majors have higher earning potentials than others. Consider the long-term financial implications of your chosen major and how it aligns with your career goals. This can help you avoid excessive student loan debt and improve your overall financial situation after graduation.

Conclusion

Reducing college costs is a key consideration for students in today's world. By implementing the strategies and tips outlined in this guide, you can alleviate some of the financial burdens associated with pursuing higher education. At The Knowledge Nest, we strive to empower students to make informed decisions and thrive academically while being mindful of their finances.

Remember, each student's financial situation is unique, so it's essential to evaluate your options and choose the approaches that work best for you. By taking control of your college costs, you can embark on your educational journey with confidence and financial peace of mind.